Source: Bloomberg, September 30 2019

Foreign investors pared their holdings of Indonesian stocks as escalating political demonstrations added to worries of a slowdown in Southeast Asia’s largest economy.

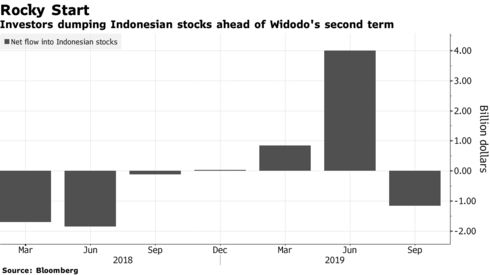

Net foreign selling in the equity market reached $1.2 billion in the third quarter, set for the biggest outflow since the second quarter of 2018, according to data compiled by Bloomberg. The selloff trims the year-to-date net inflow to $3.7 billion.

Investors have been worried that earnings will slump as growth in gross domestic product slows to 5.05%, the weakest in two years. To make matters worse, thousands of demonstrators took to the streets of Jakarta last week as part of countrywide protests aimed at forcing the government to reconsider legislation rights that groups say will curtail civil liberties.

The trouble signals a tough path ahead for President Joko Widodo, popularly known as Jokowi, before he starts his second term next month. He managed to lead with a wider margin during the re-election in April and is expected to name his new cabinet after the Oct. 20 inauguration.

“The economic slowdown has been caused by a wait-and-see attitude among investors in the lead up to the cabinet formation,” said Harry Su, head of equity capital markets at Samuel International. “Continued demonstrations and skirmishes on the ground are adding to worries and contributed to the biggest net foreign outflow since June 2018.”

Su said he would advise clients to maintain their holdings of defensive stocks and wait for Widodo to decide on his new cabinet.

Widodo also has to deal with new police and military clashes with separatist forces in the province of Papua in which at least 30 people were killed.

“The current situation is undoubtedly not conducive to investment,” Su said. “I find the degree of flash point emergence to be highly unexpected.”