With a new Presidential decree supporting the development of battery-powered electric vehicles, Indonesia has joined a host of nations that are pushing ahead this new technology. Part 1 of this article explores the opportunities that exist for investors.

Editor: Shoeb Z Kagda

The race is on.

On August 8 President Joko “Jokowi” Widodo signed the decree in support of the BEV Industry, the processing of raw materials and manufacturing of electric vehicles.

This was news business leaders, industrial and manufacturing companies, and multiple other actors have long awaited.

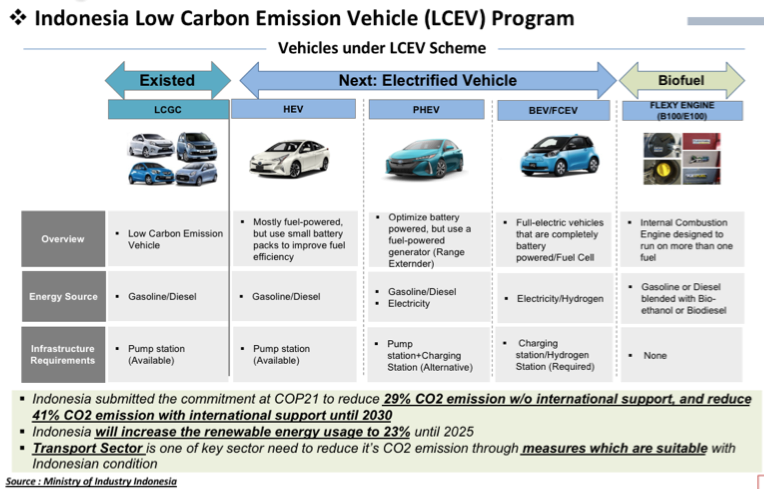

The Presidential Decree Number 55 2019, concerning the Battery-based Electric Vehicle (BEV) scheme and its implementation for road transportation in Indonesia aims to boost electric vehicles in the country and is part of the government’s commitment to reduce carbon dioxide (CO2) emissions by 29% no later than 2030.

Jakarta, the nation’s capital is choking under pollution with the metropolis being ranked as one of the most polluted cities in the world. Road transportation touted as a primary contributor to air pollution in urban areas, will enter a new phase. Today, cars account for 23% of emissions according to the Greater Jakarta Transportation Agency,. Most emissions stem from conventional vehicles using internal combustion engines (ICE), which typically run on gasoline and diesel, the latter emitting heavier CO2.

The wheels are already in motion for the government to ensure that EVs become a reality. With this, the move to lower emissions will see car owners to switch to more fuel-efficient vehicles – such as electric vehicles in the very near future.

Industry Abuzz

At a recent industry dialogue on EVs, French Ambassador to Indonesia, Olivier Chambard noted that the auto industry will be the cornerstone France’s manufacturing sector and it has clear efforts to achieve climate change objectives. French companies, he added, stand ready to work with Indonesia to develop EVs.

“The electric vehicle is not a far-off objective for Indonesia,” he said. “France and French companies want to be strong partners for Indonesia’s push toward electric mobility and we see this as a new approach to enhance bilateral co-operation.”

Djoko Santoso, Secretary General of the Ministry of Transportation said the country aims to start producing EVs in 2022 but it has taken more than two years for the government to get to this point. According to some auto industry sources, the major stumbling block have been existing players auto makers who dominate the car industry.

Hopefully, that may now change as companies such as Toyota and Hyundai have expressed interest in building EV plants in Indonesia along with Chinese companies BYD and JAC.

Indonesia is already a major auto maker in Southeast Asia, producing 1.25 million vehicles in 2018 and 1.5 million units of motor vehicles expected in 2020. The plan is to have 10% or 150,000 of these to be EVs, and onwards to a 30% mix by 2035.

A Role in BEV Industry Development: Nickel

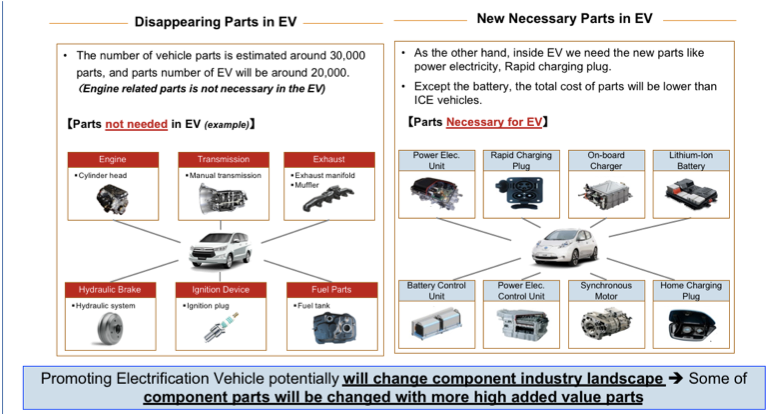

In tandem with this shift, industry players expect a shift in the manufacturing of motor components to more value-added parts.

Efforts are underway to explore alternative fuels, including those suggested in the Indonesia Development Electric Vehicle presentation by Association of Indonesian Motor Vehicle Industry (PT GAKINDO) – which include a mix of fuel oil and palm oil and a green fuel, to produce diesel and gasoline.

Another shift is the move to the Li-ion batteries, for example, a component in most plug-in hybrid electric vehicles (PHEVs) and all-electric vehicles (EVs) which rely on nickel. The advantage in using nickel in batteries is its higher energy density in addition to a greater storage capacity for lower cost.

Indonesia has rich nickel reserves of around 3.5 million wet tonnes, according to Alexander Barus, coordinating executive director of PT Indonesia Morowali Industrial Park (IMIP) – and foreign investors are eyeing the same.

China’s Tsingshan Group and partners including GEM Co Ltd recently announced that they are building a $700 million high pressure acid leaching (HPAL) plant at the IMIP, aimed at producing battery-grade nickel chemicals by 2020 on Sulawesi island, a nickel mining hub.

Barus mentions that though exports from HPAL plant will mainly go to China, the government is hoping Indonesia will create its own downstream industry. This will perhaps assist the development of: building a supply chain for the electric vehicle battery industry, producing more nickel-cobalt battery raw materials, and thus high quality energy storage raw materials.

Requirements, Incentives and Locations for BEV Businesses in EV Production

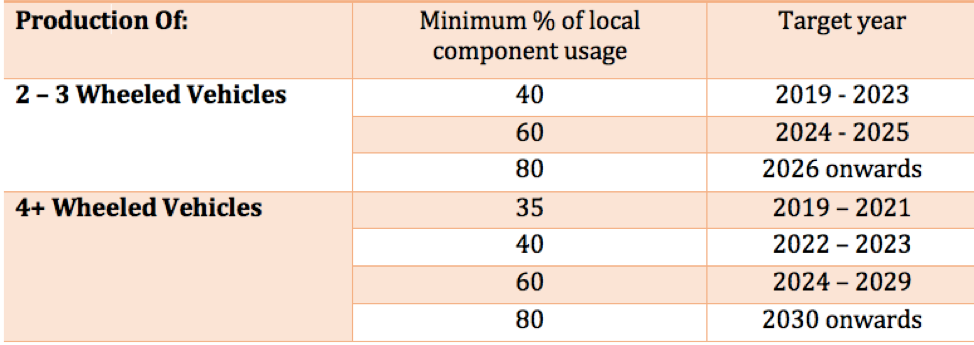

The government has set in its decree the need to use a minimum percentage of local components for EV production for businesses that apply for BEV manufacturing facilities.

Rule for Electric Motorized Vehicle Production

Those in the BEV industry that plan to build a domestic BEV manufacturing facility are also allowed to import a completed vehicle, but only for a certain period of time and for a certain amount to jump start the construction of BEV manufacturing facilities, for each phase of production, as set by the Ministry of Finance.

The Ministry has also stipulated that pioneering BEV manufacturers are eligible to receive benefits for a tax holiday, tax exemption, and tax allowance, for the classifications listed in the standard classification of Indonesian business fields (KBLI),

Several primary locations have been earmarked, with Karawang, one of the cities in West Java, as the most ideal place for the BEV industry.

Karawang is Indonesia’s largest industrial city with 13,756,358 hectares (Ha) plotted as industrial land and is divided into several industrial zones. There are multiple industries also established there including automotive, IT, electronics, and other enterprises. Gersik, a town within the East Java Province of Indonesia, is another viable alternative and boasts one of the largest and potentially fastest growing industrial estates, as depicted by this Data Flow.

More information about the strategy and development of the BEV Industry is available from the Ministry of Industry and Indonesia’s Investment Coordinating Board.

Notwithstanding, the industry will face some bumps in its early implementation stages, in which Indonesia’s government and BEV manufacturers, investors can play a role.

In the next part of this article, we will discuss some pressing issues and options that investors can leverage on.