Editor: Shoeb Z Kagda

In quelling air pollution in the capital, the implementation of Presidential Decree Number 25 2019 is seen as a viable solution. However, with new solutions come new obstacles. Part 2 addresses concerns about charging stations and partnership opportunities with local companies.

In spite of the exciting opportunities that kept the automotive industry abuzz with the Presidential Decree on electric vehicles (BEV), there are also questions hindering the implementation process of the BEV Industry. Two of them being the development of electric charging stations (CS) and corresponding incentives for producers and consumers.

Charging Stations: Infrastructure and Incentives

Charging stations (CS) make up a crucial element in the implementation of the BEV Industry. Of these, priority is the placement and production of charging stations. Instruments related to the creation of charging stations must also adhere to rules of BEV production, detailed in the first part of the article. Companies interested in investing and building CS must work with the Discussing and Implementing Technology Board (Badan Pengkajian Dan Penerapan Teknologi or BPPT) on technical aspects. Actors from the government, and private funded companies will also work with the state-owned utility company PLN (Perusahaan Listrik Negara) for the phased rollout.

Complimentary issues include strategic placements of CS, licences and related permits, incentives from the government to investors, consumers, public transportation, and the charging price for EVs.

The government is also looking into subsidization and tax incentives across the board to improve demand. These include promotions for consumers to buy EVs, incentive to convert public transportation vehicles to use EVs, and most importantly the price of using EV transportation which is currently too expensive.

EV Adoptability Preparation

PLN has said that it is ready to work with EV producers and already have multiple types of electric charging stations. According to a Jakarta Post article, this year PLN is set to invest Rp 6 billion (US$ 424,000) in installing 22 CS; 18 will comprise of regular stations, 3 fast-charging stations, and 1 ultra-fast charging station. PLN’s Greater Jakarta distribution general manager Ikshan Asaad added that PLN aims to install a total of 160 CS nationwide, working alongside Pertamina, state-owned energy company, and Jasa Marga, state-owned toll operator.

By 2025, Indonesia aims to have 2.1 million electric motorcycles 2,200 hybrid or EVson the roads.

Original equipment manufacturers (OEMs), automotive makers and infrastructure providers including Transjakarta, a rapid bus transit system; Maxindo Renault, Blue Bird, and Pelindo 2 are already active in discussions with the government.

Challenges and Trials

Mr. Agung Wicaksono, Transjakarta’s Managing Director said he aims to adhere to a future goal of 0% emissions from Transjakarta’s fleet. He disclosed the bus system’s status being in the pre-trial process, and is currently testing electric buses filled with water tanks as an alternative for people in isolated areas. He also mentioned that multiple product developers have requested to be involved in the pre-trial or the trial process.

Maxindo Renault’s Andrew Limberg mentioned Portos Santos, the first fossil-free island in Portugal utilizing wind and solar energy and not gasoline oil as an example of what the future of transportation could look like. In the long run, he believes that the reliance on oil mining would move towards nickel mining.

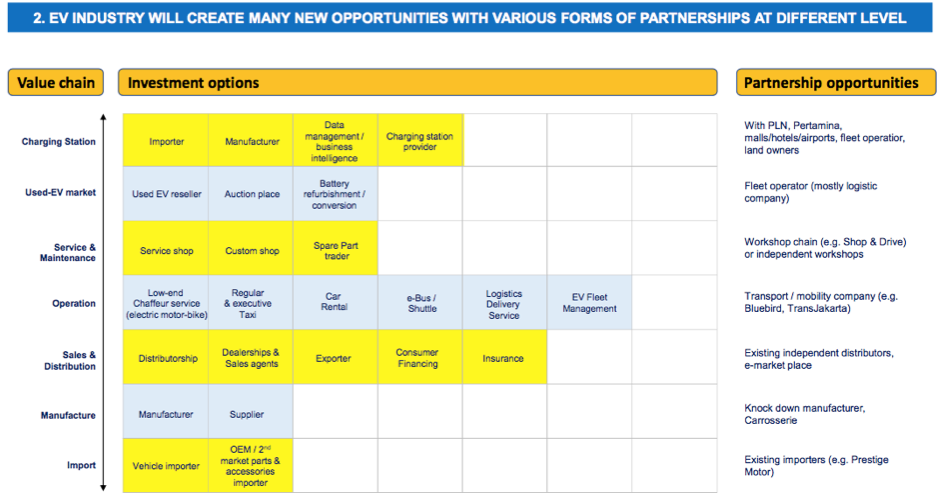

Director of Blue Bird, Indonesia’s leading taxi service company, Andrianto Djokosoetono expressed their need for local BEV manufacturers and the possibility of partnerships at various levels, throughout its value chain.

Djokosoetono also mentioned six main challenges facing the private taxi company including the high cost of EV technology, local manufacturing, battery disposal, public charging infrastructure, government support, and the buoyant used-vehicle market.

It is evident that in order for Indonesia’s ambitions of reducing carbon emissions by 29% by 2030 and boosting local manufacturing development, private and state-owned enterprises need to work together to accelerate the implementation of electric vehicles in Indonesia.